Godfrey Bloom is a member of the British Parliament. His in-your-face style of educating and shocking his peers has made him a controversial politician. He has occasionally been escorted out of the assembled parliament because of his rowdy rhetoric.

Consider the video below. Bloom offers a critical, but simple and clear explanation of the Fractional Reserve banking system used in the US and Europe. This gets to the heart of the matter! [continue below video]…

Conclusion (mine, and not Mr. Bloom’s): It is in the interest of governments to use a form of money that they cannot manipulate, print, spend, hide or lend without first earning, taxing or legitimately borrowing — and then balancing the books, openly.

Bitcoin is such a currency. Any country that adopts an open source, permissionless, and completely transparent monetary instrument will demonstrate to citizens and taxpayers that they respect their constituents and that they commit to balance their books like any state, corporation, NGO or household.

Would an ethical government surrender control of its own monetary policy? H*ll, yes! This is how a government avoids rampant inflation and the burden of non-consensual debt to future generations. It is also how a government makes taxation, redistribution and spending transparent and accountable. It is how a government restores trust.

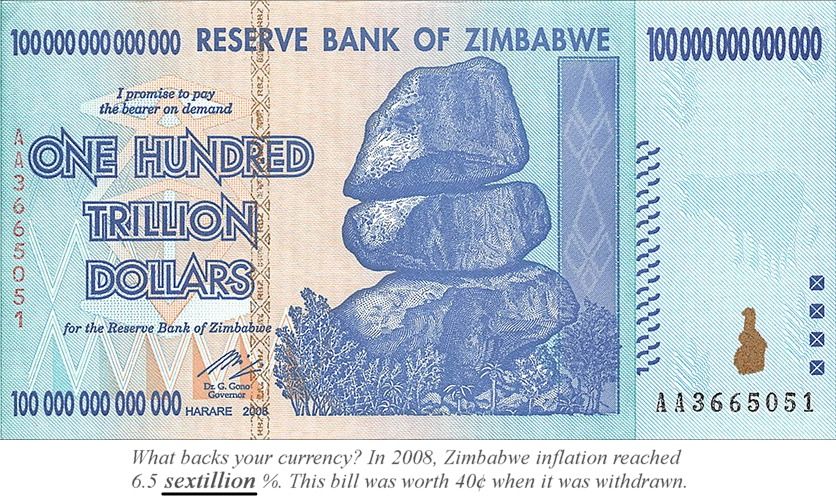

We have been raised with centuries of dogma that teach us to accept inflation, and a constantly escalating public debt. Sometimes, the path forward is not immediately obvious. But history doesn’t lie. When trusted nations with large economies manipulate interest rates, borrow without a lender, or inflate a nation out of a crisis (what the US calls “quantitative easing”), the long term effect is certain to be no different than Argentina, Zimbabwe, Venezuela or Germany between the wars. It is a recipe for disaster. It places every citizen and their future children into debt-bondage.

Moving away from the Gold Standard in the 1970s was a risky maneuver. The risk was not abandoning a precious metal with intrinsic value—but rather it placed the full faith and credit of our economy in the hands of transient politicians, rather than in a capped commodity with certain and immutable properties.

Bitcoin is the new gold. It is capped, transparent, open-source, vetted and without a mechanism for quick or covert manipulation (the US calls this “raising the debt ceiling” and they do it every few months!). We may not move to an economy based on Bitcoin today or tomorrow, but that day is coming. Thankfully, it’s coming!

- Related: Is Cryptocurrency Good for Government?

Philip Raymond co-chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. He was speaker at Cryptocurrency Conferences in Dubai, South Africa and India. Click Here to inquire about a presentation.