Today, I was asked to answer this question at Quora:

“What sets each cryptocurrency apart from the others?”

“Cryptocurrency” is a broad term. It refers to payment coins, of course—such as Bitcoin and Litecoin. But, because most tradeable tokens attain an asset value, the word is often used to refer to smart contract devices, such as Ethereum, a host of other blockchain based tokens, functional Internet-of-Things tokens, and even ICOs (Initial Coin Offerings). Since people treat ICOs and IOT tokens as investment instruments even if they are useless as a payment mechanism, they all fall within the realm of a cryptocurrency.

So, before addressing the question, let’s distinguish between Altcoins and ICOs. I assume the question refers to Altcoins, and not ICOs…

ICOs are almost all scams. A very few of these are designed to function in a well-defined IOT role (Internet-of-Things). But, any ICO that you are likely to hear about share one or more traits described here.

But Altcoins are different. These are typically forked from Bitcoin or another established blockchain-backed coin. They are created because developers feel that they have solved one or more of the problems that limit the growth or appeal of Bitcoin. For example, Bitcoin has (or recently had) all these problems or perceived limitations:

- Transaction Malleability (Recently solved with activation of SegWit)

- Speed of transaction (Now being addressed by Lightning Network)

- Cost of transaction (Also addressed by Lightning Network early 2018)

- Very high electrical demand by miners (Still a major problem)

- Fairness of and speed of distributed governance process (a big problem)

- Finding a validation incentive after mining runs out (a long term issue)

- Deep privacy features. These are inherent to Monero and Zcash. (Bitcoin will soon support onion routing transactions to enhance privacy)

- Disparate goals of miners, developers, vendors and users (still a problem)

- Limited Smart Contract mechanism (Ethereum is the current king in this realm, with slick methods of administering and executing contracts. Bitcoin will eventually acquire these features & benefits.

- Like ICOs (these are almost all scams), some Altcoins (not scams) address specific IOT applications. This is a legitimate and non-payment use of blockchain technology. It represents a promising evolution. It is not yet clear if Bitcoin can eventually adopt these features and function in a non-payment, IOT capacity. The intrinsic, stored value aspect of Bitcoin would make it difficult to use in such applications.

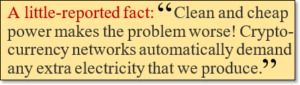

One big problem facing Bitcoin is that the distributed consensus mechanism that makes it a trusted, peer-to-peer mechanism is based on Proof-of-Work (POW). Coupled with a mining incentive that increases dramatically with exchange rate, Bitcoin is—quite simply—untenable. With consumption topping 33 terawatt hours in December 2017, it already consumes more power than some countries. If even 2% of the world’s payment transactions were settled in Bitcoin, the mining would consume more power than is generated throughout the world. This just cannot continue!

One big problem facing Bitcoin is that the distributed consensus mechanism that makes it a trusted, peer-to-peer mechanism is based on Proof-of-Work (POW). Coupled with a mining incentive that increases dramatically with exchange rate, Bitcoin is—quite simply—untenable. With consumption topping 33 terawatt hours in December 2017, it already consumes more power than some countries. If even 2% of the world’s payment transactions were settled in Bitcoin, the mining would consume more power than is generated throughout the world. This just cannot continue!

Fortunately, developers and armchair inventors have proposed or demonstrated clever POW alternatives to achieve a fair distributed consensus. Some of these use a Proof-of-Stake mechanism, while others add a limited central-authority nexus to facilitate governance and scaling. Some are built on a modified blockchain that weaken several pillars of a true decentralized, p2p network. Of course, researchers are concerned that these systems deteriorate the decentralized nature of Satoshi’s original blockchain.

But, other systems may allow for a fully distributed and democratic trust platform, such as BFT Replication (IBM) or Distributed Objective Consensus, which was proposed by an amateur mathematician.

In reply to the title question, Altcoins are set apart by their claim to address the above problems & limitations, or to add features.

Will an Altcoin Triumph over Bitcoin?

Perhaps, a few altcoins will thrive, due to specific niche advantages; features that Bitcoin chooses not to address, such as deep anonymity or with a novel utilitarian feature that facilitates a specific Internet-of-Things process.

Unfortunately for altcoins, all coins require public trust and transparency. For this reason, they are open source, permissionless, without licensing, without patent protection and with a fully disclosed pre-mining history. And for that reason, Bitcoin is free to steal any clever advantage that works. It’s all up for grabs and no one can be sued.

In effect, each altcoin as a beta test platform for Bitcoin. Now that Bitcoin is finally addressing the problems of scalability and fair/speedy governance, there is little doubt that it will continue to dwarf other coins.

Philip Raymond sits on Lifeboat’s New Money Systems board. He co-chairs CRYPSA, hosts the New York Bitcoin Event and is keynote speaker at Cryptocurrency Conferences around the world. Book a presentation or consulting engagement.

For now, however, cryptocurrencies continue to go from strength to strength with new ones being created seemingly every other day. Investors, undeterred by the possibility of the ‘bubble bursting’, are flocking to this new market in hopes of gaining returns on their investment that just can’t be matched by any stock exchange in the world.