This is Episode 7 in a series of videos discussing the General Theory of General Intelligence as overviewed in the paper.

Goertzel, Ben. “The General Theory of General Intelligence: A Pragmatic Patternist Perspective.“

https://arxiv.org/pdf/2103.15100

This episode overviews ideas regarding how the particular nature and requirements of *human-like-ness* can be used guide the design and education of AGI systems. This is where cognitive science and computer science richly intersect. Core architectural ideas of OpenCog along with numerous other AGI systems (MicroPsi, LIDA, Aaron Sloman’s work,…) are reviewed in this context.

Some additional references relevant to this episode are:

Goertzel, Ben. “The Embodied Communication Prior: A characterization of general intelligence in the context of Embodied social interaction.” In 2009 8th IEEE International Conference on Cognitive Informatics, pp. 38–43. IEEE, 2009.

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.352…1&type=pdf.

Bengio, Yoshua. “The consciousness prior.” 2017

https://arxiv.org/pdf/1709.08568

Goertzel, Ben, Matt Iklé, and Jared Wigmore. “The architecture of human-like general intelligence.” In Theoretical foundations of artificial general intelligence, pp. 123–144. Atlantis Press, Paris, 2012.

http://citeseerx.ist.psu.edu/viewdoc/summary?doi=10.1.1.352.1548

Ben Goertzel, Cassio Pennachin, and Nil Geisweiller. Engineering.

General Intelligence, Part 1: A Path to Advanced AGI via Embodied Learning and Cognitive Synergy. Springer: Atlantis Thinking Machines, 2013.

https://1lib.us/book/2333263/7af06e?id=2333263&secret=7af06e.

Ben Goertzel, Cassio Pennachin, and Nil Geisweiller. Engineering.

General Intelligence, Part 2: The CogPrime Architecture for Integrative, Embodied AGI. Springer: Atlantis Thinking Machines, 2013.

https://1lib.us/book/2333264/207a57?id=2333264&secret=207a57

–

SingularityNET is a decentralized marketplace for artificial intelligence. We aim to create the world’s global brain with a full-stack AI solution powered by a decentralized protocol.

We gathered the leading minds in machine learning and blockchain to democratize access to AI technology. Now anyone can take advantage of a global network of AI algorithms, services, and agents.

Website: https://singularitynet.io.

Forum: https://community.singularitynet.io.

Telegram: https://t.me/singularitynet.

Twitter: https://twitter.com/singularity_net.

Facebook: https://facebook.com/singularitynet.io.

Instagram: https://instagram.com/singularitynet.io.

Github: https://github.com/singnet

Category: blockchains – Page 13

The Future of AI-Generated Art Is Here: An Interview With Jordan Tanner

Unlike many of the so-called “artists” strewing junk around the halls of modern art museums, Jordan Tanner is actually pushing the frontiers of his craft. His eclectic portfolio includes vaporwave-inspired VR experiences, NFTs & 3D-printed figurines for Popular Front, and animated art for this very magazine. His recent AI-generated art made using OpenAI’s DALL-E software was called “STUNNING” by Lee Unkrich, the director of Coco and Toy Story 3.

We interviewed the UK-born, Israel-based artist about the imminent AI-generated art revolution and why all is not lost when it comes to the future of art. In Tanner’s eyes, AI-generated art is similar to having the latest, flashiest Nikon camera—it doesn’t automatically make you a professional photographer. Tanner also created a series of unique, AI-generated pieces for this interview which can be enjoyed below.

Thanks for talking to Countere, Jordan. Can you tell us a little about your background as an artist?

Hackers Loot Blockchain Bridge for Millions In “Frenzied Free For All”

On Monday, hackers exploited a basic vulnerability in the code of Nomad — a crypto “bridge” that allows customers to transfer cryptocurrencies between different blockchains — getting away with roughly $190 million in user investments, CNBC reports.

This hack is just the latest in a string of attacks on crypto bridges, platforms that, according to CNBC, have collectively lost more than $1 billion to hackers in 2022 alone.

Given that Nomad markets itself as a “secure” platform, the company definitely has a lot of explaining to do.

Colombia Enlists Ripple Labs to Put Land Deeds on Blockchain

Colombia’s government has launched a partnership with Ripple Labs, the company behind the cryptocurrency XRP, to put land titles on the blockchain, part of a plan to rectify land distribution efforts so unfair they’ve led to decades of armed conflict.

The project, built by blockchain development company Peersyst Technology and Ripple, will permanently store and authenticate property titles on Ripple’s Ledger—its public blockchain.

This will help eliminate bureaucracy and hopefully make land distribution more equal, Ripple Labs and Peersyst Technology told Decrypt.

#58 Dr. Ben Goertzel — Artificial General Intelligence

Patreon: https://www.patreon.com/mlst.

Discord: https://discord.gg/ESrGqhf5CB

The field of Artificial Intelligence was founded in the mid 1950s with the aim of constructing “thinking machines” — that is to say, computer systems with human-like general intelligence. Think of humanoid robots that not only look but act and think with intelligence equal to and ultimately greater than that of human beings. But in the intervening years, the field has drifted far from its ambitious old-fashioned roots.

Dr. Ben Goertzel is an artificial intelligence researcher, CEO and founder of SingularityNET. A project combining artificial intelligence and blockchain to democratize access to artificial intelligence. Ben seeks to fulfil the original ambitions of the field. Ben graduated with a PhD in Mathematics from Temple University in 1990. Ben’s approach to AGI over many decades now has been inspired by many disciplines, but in particular from human cognitive psychology and computer science perspective. To date Ben’s work has been mostly theoretically-driven. Ben thinks that most of the deep learning approaches to AGI today try to model the brain. They may have a loose analogy to human neuroscience but they have not tried to derive the details of an AGI architecture from an overall conception of what a mind is. Ben thinks that what matters for creating human-level (or greater) intelligence is having the right information processing architecture, not the underlying mechanics via which the architecture is implemented.

Ben thinks that there is a certain set of key cognitive processes and interactions that AGI systems must implement explicitly such as; working and long-term memory, deliberative and reactive processing, perc biological systems tend to be messy, complex and integrative; searching for a single “algorithm of general intelligence” is an inappropriate attempt to project the aesthetics of physics or theoretical computer science into a qualitatively different domain.

Panel: Dr. Tim Scarfe, Dr. Yannic Kilcher, Dr. Keith Duggar.

Pod version: https://anchor.fm/machinelearningstreettalk/episodes/58-Dr–…e-e15p20i.

U.S. government recovers nearly $500,000 from North Korean hack on Kansas medical facility

The U.S. Department of Justice seized roughly $500,000 in ransom payments that a medical center in Kansas paid to North Korean hackers last year, along with cryptocurrency used to launder the payments, Deputy Attorney General Lisa Monaco said Tuesday.

The hospital quickly paid the attackers, but also notified the FBI, “which was the right thing to do for both themselves and for future victims,” Monaco said in a speech at the International Conference on Cyber Security at Fordham University in New York City.

The notification enabled the FBI to trace the payment through the blockchain, an immutable public record of cryptocurrency transactions.

DARPA-Funded Study Provides Insights into Blockchain Vulnerabilities

The architecture and evolution of planetary systems are shaped in part by stellar flybys. Within this context, we look at stellar encounters which are too weak to immediately destabilize a planetary system but are nevertheless strong enough to measurably perturb the system’s dynamical state. We estimate the strength of such perturbations on secularly evolving systems using a simple analytic model and confirm those estimates with direct N-body simulations. We then run long-term integrations and show that even small perturbations from stellar flybys can influence the stability of planetary systems over their lifetime. We find that small perturbations to the outer planets’ orbits are transferred between planets, increasing the likelihood that the inner planetary system will destabilize.

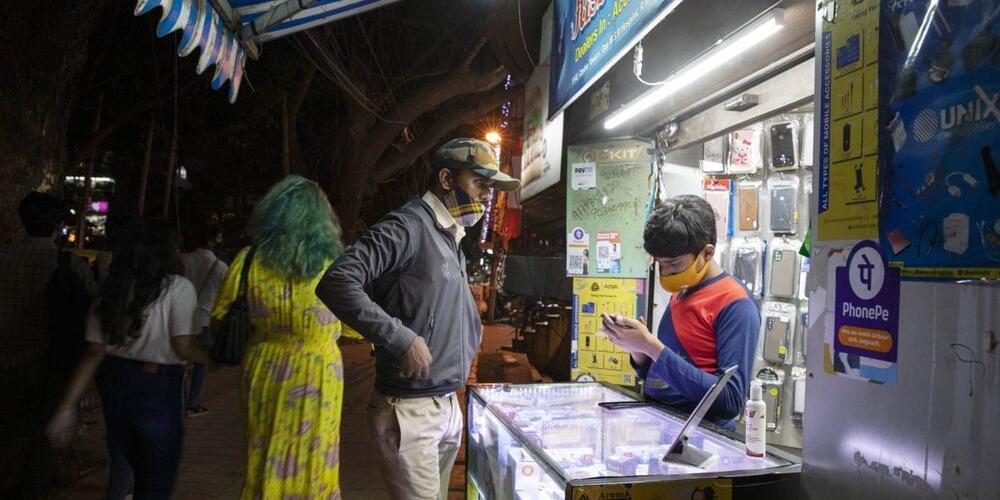

As Silicon Valley dreams about Web3, India’s UPI leaps ahead

UPI, an cheap(currently free), proven, alternative payments system designed to be secure, reliable, and interoperable among different payment companies, encouraging a innovative ecosystem.

India’s UPI payment platform is delivering on financial inclusion in ways that Bitcoin and blockchain have yet to do.