If you are reading this on January 16, 2018, then you are aware that Bitcoin (and the exchange rate of most other coins) fell by 20% today. Whenever I encounter a panic sell-off, the first thing that I do is try to ascertain if the fear that sparked the drop is rational.

But what is rational fear? How can you tell if this is the beginning of the end, or simply a transient dip? In my book, rational fears are fundamental facts like these:

- A new technical flaw is discovered in the math or mining

- A very major hack or theft has undermined confidence

- The potential for applications that are fast, fluid and ubiquitous

has dropped, based on new information*

Conspicuously missing from this list is “government bans” or any regulation that is unenforceable, because it fails to account for the design of what it attempts to regulate. Taxes, accounting guidelines, reporting regulations are all fine! These can be enforced. But banning something that cannot be banned is not a valid reason for instilling fear in those who have a stake in a new product, process, or technology.

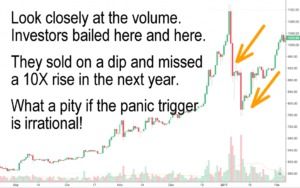

Rule of Acquisition #1:

Drops triggered by false fears present buying opportunities

At times like this, you must make a choice: If you can’t afford to stay in the market and risk a bigger drop, then cash out and live with it. But if you believe in crypto and the potential for a digital future that dis-intermediates your earning, spending and savings, then this drop in dollar value presents opportunity.

At times like this, you must make a choice: If you can’t afford to stay in the market and risk a bigger drop, then cash out and live with it. But if you believe in crypto and the potential for a digital future that dis-intermediates your earning, spending and savings, then this drop in dollar value presents opportunity.

This downturn will pass, because the cryptocurrency fundamentals have not changed or been undermined by recent events. There is no new technical flaw or hack. The potential for cash transactions and future applications get rosier every day (let’s assume that Bitcoin will finally add Lightning Network and that miners will stop fighting with developers)*

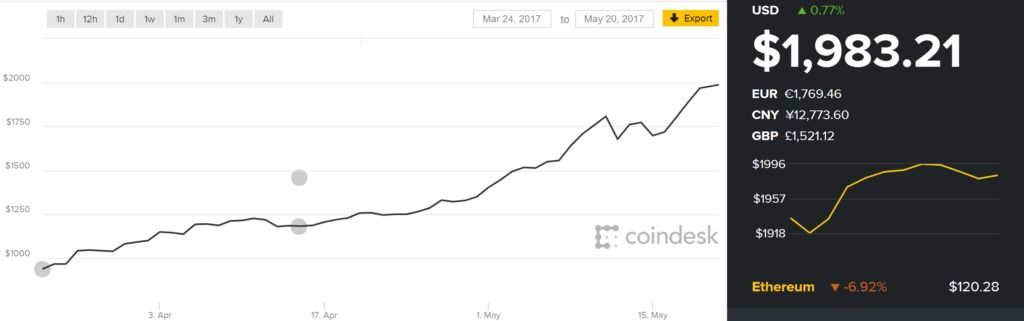

The current 20% drop is not a big deal. It takes us back to an exchange rate that we saw just one month ago in early December. It was triggered by saber rattling in South Korea. But, let’s face it: Governments have as much influence over trading or spending cryptocurrency as they do over the mating of squirrels in your backyard. Do you think fewer squirrels would mate, if the government banned them from mating?

If you can answer that question—and if you can afford to stay in the game—then relax. 1 BTC has the same value today as it had yesterday and the day before. It is worth exactly one bitcoin. The current dip in exchange rate with other currencies was sparked by fear; and that fear is misguided or irrational.

[click below for perspective]…

* Bitcoin has a serious limitation in transaction throughput and transaction cost. The problem is serious and it frustrates users, developers, miners and vendors. But it is not new, and the consensus about its likelihood of being corrected has not suddenly changed. These limitations are unrelated to today’s large drop in exchange value.

Philip Raymond co-chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. He is keynote speaker at the Cryptocurrency Expo in India this month. Click Here to inquire about a presentation or consulting engagement.

but adoption that mirrors the shift in our very understanding of bookkeeping, trust and transparency.

but adoption that mirrors the shift in our very understanding of bookkeeping, trust and transparency.